Rent vs. Buy: Which Option is Best for You?

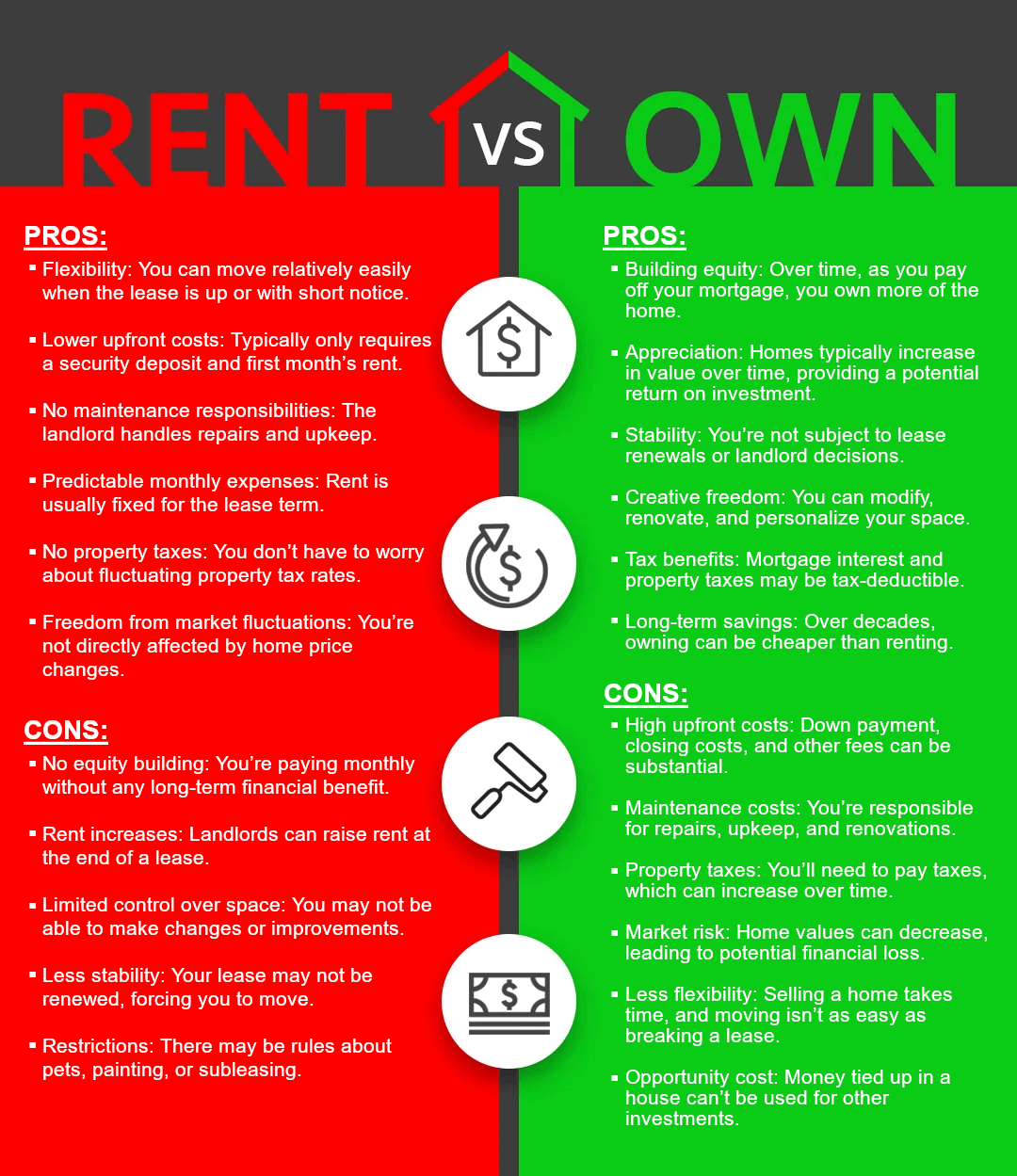

The decision between renting and buying a home is one of the most significant financial choices you’ll make in your lifetime. It's a classic debate with no universal answer, as the right decision depends on various factors, including your financial situation, long-term goals, and lifestyle preferences. In this blog, we'll explore the pros and cons of renting versus buying, helping you weigh your options and make an informed decision.

The Case for Renting

Flexibility and Mobility:

One of the main advantages of renting is the flexibility it offers. If you're someone who values the ability to move frequently or may not be ready to commit to a specific location, renting provides the freedom to relocate without the burden of selling a property. This is especially important for those whose careers or personal situations require regular moves.

Lower Upfront Costs:

Renting typically requires a security deposit and the first month’s rent, which is significantly less than the down payment and closing costs involved in buying a home. For individuals who are saving for other financial goals or want to keep their upfront expenses low, renting can be the more attractive option.

No Maintenance Responsibilities:

Another benefit of renting is that the landlord is generally responsible for the upkeep and repairs. From fixing a leaky faucet to replacing a broken appliance, you can count on the property owner to handle it. This saves both time and money, offering peace of mind to renters who don’t want the hassle of home maintenance.

Predictable Expenses:

Rent is typically fixed for the term of your lease, making it easier to budget. While rent increases are possible, they tend to happen less frequently than the cost fluctuations involved in homeownership (e.g., property taxes, unexpected repairs, etc.).

Downsides of Renting:

On the flip side, renting means you won’t be building equity. Every rent payment is essentially money that you won’t see again, which can be frustrating when you consider that monthly payments on a mortgage go toward owning the home outright in the long run. Additionally, renters have little control over their living situation—landlords can raise rent, sell the property, or decline to renew your lease.

The Case for Buying

Building Equity and Wealth:

Buying a home is often seen as a smart investment because it allows you to build equity over time. As you pay down your mortgage, you gradually own a larger portion of the property, which can increase in value over time This can be a powerful wealth-building tool, especially if home values in your area appreciate.

Stability and Control:

When you own a home, you have complete control over your living space. Want to knock down a wall to create an open floor plan? Go for it. Want to paint the walls or remodel the kitchen? You’re free to make those changes without needing permission. Ownership also offers stability, as you won’t have to worry about a landlord’s decisions affecting your living situation.

Tax Benefits:

Homeowners may also enjoy significant tax advantages, such as the ability to deduct mortgage interest and property taxes from their taxable income. While tax laws vary, this can lead to substantial savings, especially in the early years of homeownership when interest payments are highest.

Long-Term Financial Gains:

Although the initial costs of buying a home can be steep—such as the down payment and closing costs—over time, owning a home can be cheaper than renting. Once your mortgage is paid off, your monthly housing costs are reduced to property taxes, insurance, and maintenance, which can be much less than rent in many areas.

Downsides of Buying:

However, buying a home isn’t without its challenges. The most obvious drawback is the high upfront cost. In addition to the down payment, you’ll also need to factor in closing costs, moving expenses, and any immediate repairs or renovations. Homeownership also comes with ongoing responsibilities, such as maintenance, property taxes, and homeowners insurance.

Market volatility can also be a concern. While homes tend to appreciate in value over time, real estate markets can fluctuate, potentially causing your home’s value to decrease. This is a risk that renters don’t have to worry about, as they aren’t tied to the market in the same way.

How to Decide: Rent or Buy?

There’s no one-size-fits-all answer to whether you should rent or buy. It’s important to assess your personal and financial circumstances before making a decision. Here are some key questions to consider:

1. How long do you plan to stay in the area?

If you plan on staying in one location for several years, buying may be a better long-term investment. If your plans are uncertain, renting offers more flexibility.

2. What is your financial situation?

Do you have enough savings for a down payment and emergency repairs? Are you in a stable financial position to handle mortgage payments, property taxes, and maintenance costs? Renting might be more practical if your finances aren’t yet in order.

3. What are your long-term goals?

Are you looking to build wealth and settle down, or do you value the freedom of not being tied to a property? Your future plans play a large role in determining whether to rent or buy.

4. What is the housing market like in your area?

In some regions, it’s cheaper to buy than rent, while in others, renting is more affordable. Research local real estate trends and rental markets to see what makes more sense financially.

Final Thoughts

The decision to rent or buy ultimately comes down to your financial goals, lifestyle preferences, and future plans. Renting offers flexibility and lower upfront costs, making it ideal for those not ready to settle down or who want to avoid the responsibilities of homeownership. On the other hand, buying a home provides stability, the potential for long-term financial gains, and the opportunity to build equity.

Click Here for rent vs. buy calculator.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "